26

2016 Florida Export Guide

Florida.Think.Global

O

btaining Foreign Trade Zone

status for a business can have a

significant impact on the com-

pany’s bottom line. For compa-

nies located in Pinellas, Pasco or Hernando

counties, Foreign Trade Zone (FTZ) 193 is

a way for manufacturers and distributors to

defer customs duties and taxes until mer-

chandise is transferred from the FTZ to

the domestic market. If a business is re-exporting a product,

in most cases duties can be completely eliminated.

An FTZ is a secured site within the United States, but

technically considered outside of the jurisdiction of U.S. Cus-

toms, allowing shippers to streamline customs clearance and

better manage supply chain and logistics expenses.

By using an FTZ, businesses can operate more efficiently

by effectively managing cash flow and saving a significant

amount on the cost of importing materials by deferring any

duties paid until the final sale of the product. And while duty

deferral can be substantial, companies involved in manufac-

turing or distribution operations in a foreign trade zone can

realize many more intangible savings, such as streamlining the

movements of products through a facility.

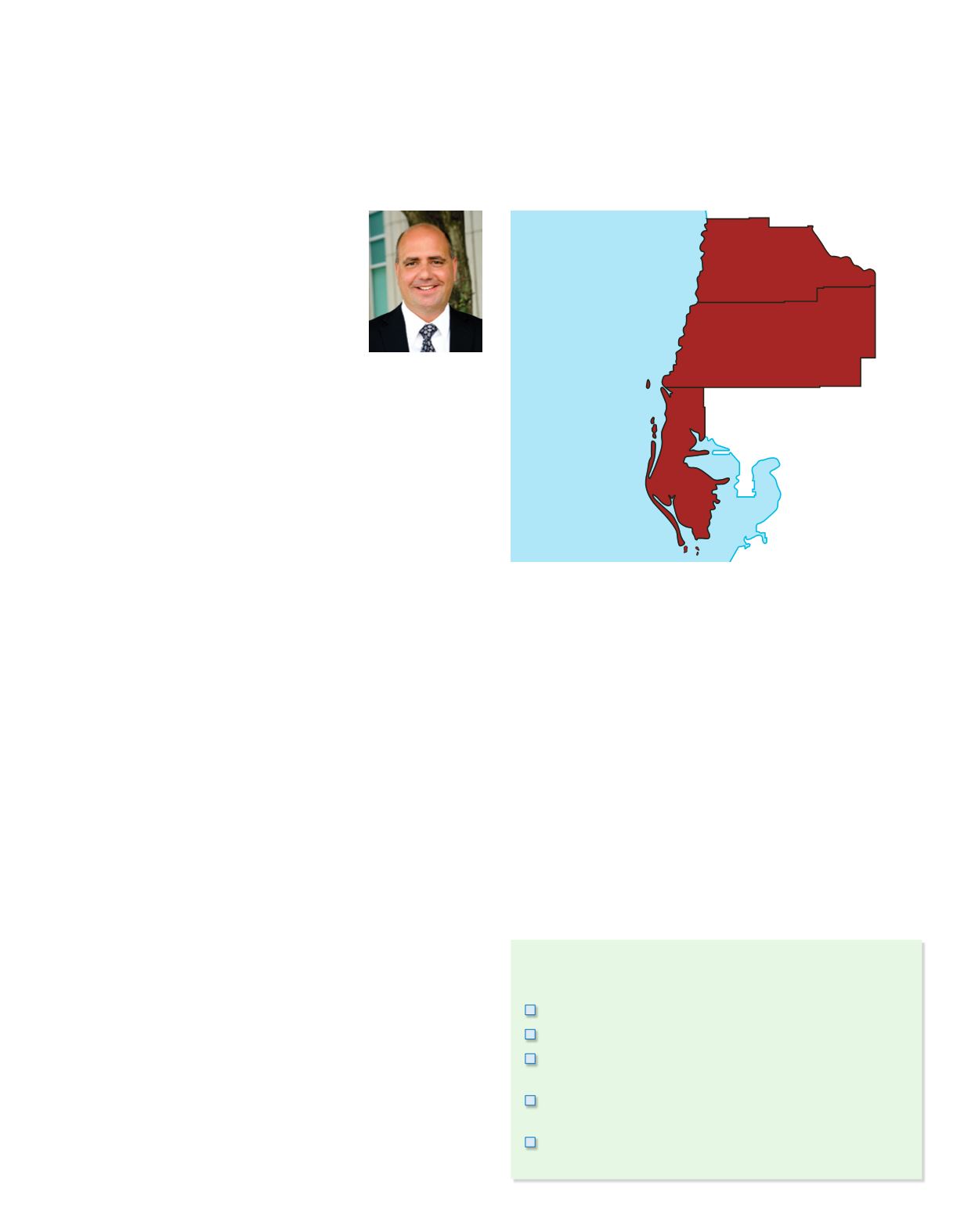

FTZ 193 encompasses more than 2,000 square miles in the

Tampa Bay region. Some of the best industrial land sites in the

United States are available within this Foreign Trade Zone.

Moreover, FTZ 193 allows for easy integration into a com-

pany’s existing site/location. Storage and distribution sites can

be approved in 30 days. Manufacturing and processing plants

can be approved within 120 days.

Companies should consider investigating FTZ 193 if

the business:

• Manufactures, assembles or processes imports.

• Exports previously imported materials.

• Regularly pays more than $485 per week in merchandise

processing fees.

• Waits long periods of time for orders to get through

customs.

• Scraps, rejects, destroys, wastes or returns some imports.

By integrating FTZ 193 into a current operation

companies can:

• Defer customs duties and taxes until merchandise is trans-

ferred from the FTZ to the domestic market.

• Reduce merchandise processing/entry fees substantially with

just one entry filed each week, and just one fee per entry.

• Reduce duties on goods processed or assembled in the

FTZ when imported components have a higher duty rate

than the finished goods.

• Eliminate duties entirely on scrap, damages, zone transfers,

and on goods re-exported.

Brent Barkway is the Business Development Manager for

Pinellas County Economic Development

More information about ForeignTrade Zone 193 is available on-

line a

t PCED.org/FTZ or by contacting Brent Barkway, Business

Development Manager, Pinellas County Economic Development at

bbarkway@pinellascounty.org or 727-464-7411.

Foreign Trade Zone 193: The Best Kept Secret

for Distribution and Manufacturing in Florida

By Brent Barkway

“An FTZ is a secured site within

the United States, but technically

considered outside of the jurisdiction

of U.S. Customs…”

Florida’s

Foreign

Trade

Zone

193

Hernando

Pasco

Pinellas

Brent Barkway

Do you manufacture, assemble or process imports?

Do you export previously imported materials?

Do you regularly pay more than $485/week in

merchandise processing fees?

Do you have to wait long periods of time for your

orders to get through customs?

Do you scrap reject, destroy, waste or return some of

your imports?

CHECKLIST

: Is an FTZ Right for Me?